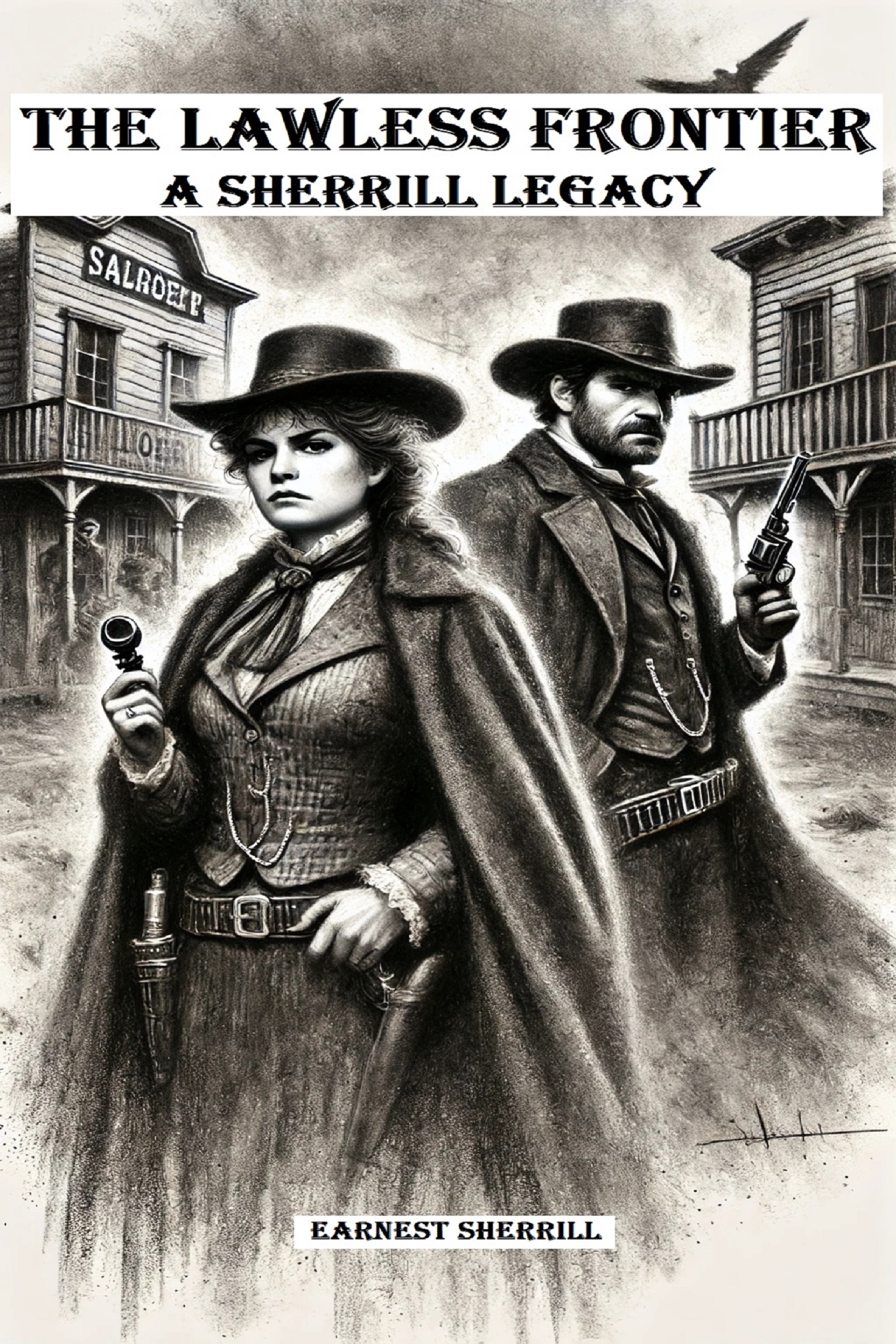

"The Lawless Frontier: A Sherrill Legacy"

*In a lawless land, justice rides on the Sherrills. Makenna, the sharp-witted sleuth, and her gun-slinging brother Jonathan must solve the darkest mysteries of the West before the frontier swallows them whole.*

*Danger. Deception. Destiny.*

*If you love Old West tales filled with secrets, shootouts, and an unbreakable family bond, The Lawless Frontier: A Sherrill Legacy is your next great read.*

*Grab your copy now and ride into the mystery.*

About the Author: Earnest Sherrill

Earnest Sherrill is a passionate outdoor enthusiast and writer who resides in the warm and breezy state of Texas. With a deep love for nature, Earnest enjoys exploring the great outdoors and sharing his experiences through his writing. He writes about various aspects of outdoor life and the intriguing happenings of everyday experiences. When not writing, Earnest cherishes spending time with his youngest grandchildren, who bring vibrant energy and robust attitudes to his life. Stay connected with Earnest to discover more about the wonders of the outdoors and the joys of life's adventures.